Student accommodation is an affordable investment that provides high yields. In the UK, it is the most resilient asset class of real estate that outperformed most other property types even through the 2008 recession.

Purpose built student accommodation (PBSA) in the South African university town of Stellenbosch is a similar price to PBSA in a Northern UK city, like Manchester, Newcastle-under-Lyme or Nottingham. Which is the better option? (See the comparison in Table 1).

“The primary differences are that South African options do not come with guarantees and fundamentally the UK is a strong economy with a stable governance and credible legal system,” says international property expert and founder of Hurst & Wills, Lisa Bathurst.

“Our UK student accommodation is completely hands-off, offering full tenant finding, management and maintenance. The units come fully furnished, including a TV, and are maintained and redecorated each year,” she says. “Most importantly they come with guaranteed yields of 7.5% net, inclusive of service charges, maintenance and tenant costs.”

There is also currency play to consider, says Bathurst. “Many economists believe that due to Brexit the pound is currently undervalued, some say by as much as 20%. So, purchasing in GBP may well yield an additional return.”

There has been some negative press about student accommodation in the UK, mainly because there is a lot of rubbish out there and investors must do proper due diligence, says Bathurst.

“Hurst & Wills does exactly that for our clients, so they don’t have to. We are independent, so we’re not tied to one developer. We work with a few developers that we trust and who have a good track record, and we regularly visit developments to check on progress.”

A case in point is the Laceworks student development in Nottingham that Alliance, partners of Hurst & Wills, have recently completed. “The development was fully sold out and is now fully constructed on time with 100% occupancy. Our clients who bought in are already receiving their guaranteed returns as promised.”

Alliance are currently working on their latest luxury student development, The Met, in Newcastle-under-Lyme. Properties are available from £73 500, with assured returns of 7.5% for 5 years and 4% interest being paid on deposited funds between exchange and completion, she says.

“The Met will also be managed and let out by the same team that so successfully did The Laceworks,” says Bathurst.

Manchester vs Melrose Arch

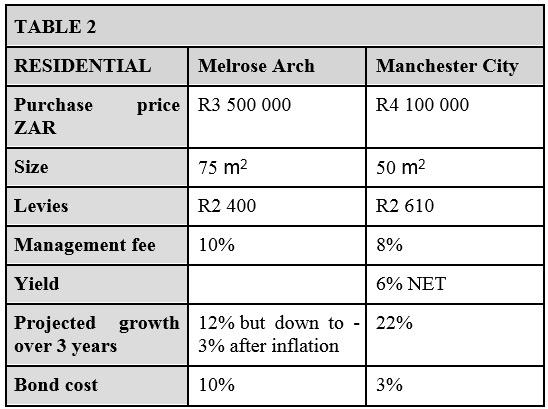

Comparing a development in Manchester’s prime central area, called Uptown, versus a new development in Melrose Arch, also a prime location, in Johannesburg, Bathurst notes that residential property is more affordable in South Africa and the rental yields are similar when looking at the net pricing. (See the comparison in Table 2).

“The differences here come down to the UK being a much more stable and strong economy and the possible currency play due to an undervalued pound,” she explains. “The most important difference is that you can borrow in UK at 3%, compared to the 10%+ bond costs on offer in SA.”

There is so much uncertainty on a global level with Brexit, the fluctuating rand, local political instability and South Africa’s financial outlook recently cut to negative, that many people think it’s best to sit tight. “We have clients who have opted to wait and see before committing to a purchase and we have seen, first hand, the cost of this decision,” says Bathurst.

“One client was due to purchase two UK student accommodations in July when the rand rate was R17.53 to the GBP, making the price per unit R1 293 750. He decided to wait for a better exchange rate, but today the rand rate is R19.53. The purchase price has now increased - in rand terms - to R1 464 750, which is R171 000 more per unit and a total extra cost of R342 000,” she says. “In another case, a client has been waiting for 12 months to see what happens with Brexit before committing to a one-bedroom apartment in Manchester. She is still waiting while last year alone this UK city saw a 16% growth and property prices have increased to reflect this.”

“Waiting too long to divest SA assets is another common situation. Unfortunately, South African property is in negative growth in real terms when you take inflation into account, so your rand-priced property decreases as your offshore property price increases,” says Bathurst.

For more information, visit the website.