After the steady streak of interest rate hikes, many South Africans might have had a crash course on just how severely interest charges can affect their monthly budgets.

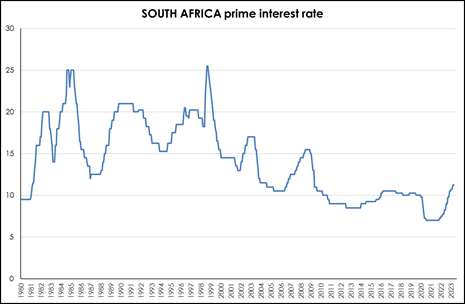

The South African Reserve Bank's Monetary Policy Committee has raised the repo rate by a further 50 basis points to 8.25%, leaving the prime lending rate at 11.75% – the highest it has been since 2009.

READ: Local property market ups and downs and tips for buying a home

“Interest rates can fluctuate from time to time, so it is important to know what this means for your monthly expenses, especially for the big-ticket items like home loans, vehicle finance agreements and credit cards,” says Regional Director and CEO of RE/MAX of Southern Africa, Adrian Goslett.

Consumers first need to understand that interest is the fee that a lender charges for lending money to a borrower. “It is important to know that interest is purely an expense. When choosing to purchase something on credit, the corresponding interest charges means that you will pay double if not triple the original amount. That is why it is better to minimise your lines of credit as far as possible and only take on good debts, such as home loans, rather than bad debts like a car loan or store account,” Goslett explains.

To understand why all debt repayments have become more expensive over the last year or so, consumers should understand that the South African Reserve Bank (SARB) meets every second month to decide whether to change the country’s interest rates to combat inflation. “When the repo rate changes – up or down – so does the prime rate: by the same percentage. This, in turn, affects all your monthly repayments,” Goslett explains.

Anyone who already has a home loan will notice that the interest payable on your loan will be included in your monthly repayment amount, so you don’t have to do the calculation yourself. But, if you want to prepare yourself ahead of time, you can use an online calculator to get an indication of how much more your monthly repayment amount will be.

If you are interested to find out how much interest you will pay over the span of your loan term, this is slightly tricky to calculate because it is based on both the outstanding balance of your loan as well as the remaining period of the loan term. This is also known as compound interest and means that the amount you owe the bank also increases every day.

READ: SARB hikes repo rate by 50bps, prime lending rate now 11.75%

He adds that if, when you start paying your loan, you pay more than the minimum amount, this will reduce the amount of interest you pay over the years. This also reduces the length of time (or term) over which you will pay and, best of all, saves you money in the long run.

“When the bank structures your repayments, they do it so that over the first few years, most of the monthly repayment goes towards paying off the total interest and a fraction is allocated to the capital amount (the actual price you paid for the property). If you focus on paying extra into your home loan in the first ten or so years of the loan term, you can maximise your savings on interest charges,” Goslett explains.

Those who are still unsure of how interest rates work are encouraged to speak to a financial advisor for further insights. “You do not want to get yourself into a situation where you do not fully understand the implications of taking on credit. While it might be necessary to take on a certain level of debt to build future wealth, this should only be done based on what you can truly afford. Once you have worked that out, speak to a local real estate professional to find out what homes are available within your price range,” says Goslett.

Samuel Seeff, chairman of the Seeff Property Group said: As result of the latest 50bps interest rate hike, monthly bond repayments over a 20-year term will increase by approximately:

R750 000 bond – extra R259 from R7 869 to R8 128

R900 000 bond – extra R310 from R9 443 to R9 753

R1 000 000 bond – extra R344 from R10 493 to R10 837

R1 500 000 bond – extra R517 from R15 739 to R16 256

R2 000 000 bond – extra R689 from R20 985 to R21 674

R2 500 000 bond – extra R862 from R26 231 to R27 093

What does the higher interest rate mean for the housing market?

Seeff says the rapidly rising borrowing cost has put a dampener on the market. First-time homebuyers, many from the emerging middle class, are facing affordability challenges, and overall sales volumes have declined, more in some areas and to a lesser degree in other markets such as the Cape.

That said, the rate is still below the average of 15% to 16%. It is also encouraging for the market that we are still seeing the best lending conditions since 2007 with strong support from the banks. Approval rates are still at over 80%, deposit requirements still at around 8%-10%, and buyers can often find a rate concession.

Seeff says prequalification for buyers is vital to ensure they are not disappointed, but to also put them in a better negotiating position. Sellers on the other hand should note that house price growth has stalled which means they need to ensure they price correctly if they are looking to sell right now. Buyers will be pressing and since they do not have to compete with too many other buyers will be looking for price concessions.

Meanwhile , Dr. Andrew Golding, chief executive of the Pam Golding Property Group, said at the time of the latest increase rate hike, that South Africa has weathered far higher interest rates in the past (see graph below), and when adjusting for inflation, the real prime rate is not as high as it was prior to the pandemic. Despite this, the higher interest rate will undoubtedly provide a challenge for the many first-time buyers who capitalised on the low rates during the pandemic in order to gain a foothold in the property market.

Against the backdrop of the current lacklustre economic outlook for South Africa, with loadshedding in particular weighing on growth prospects - especially as we head into winter- and fuelling inflation, given the considerable cost of energy alternatives such as generators and diesel used by retailers and the like, which are ultimately to be passed on the consumers, pose significant headwinds to the property market. However, people, especially young adults, require homes and many need to move to economic hubs which offer employment opportunities or a sustainable and secure life for families.

Want all the latest property news and curated hot property listings sent directly to your inbox? Register for Property24’s Hot Properties, Lifestyle and Weekly Property Trends newsletters or follow us on Twitter, Instagram or Facebook.