While national house price inflation continues to ease, slowing to 2.99% in September (2022) according to the latest Pam Golding Residential Property Index, encouragingly for investors, the pace of the slowdown is decelerating, suggesting that a lower turning point may be approaching.

Despite rising interest rates, renewed price pressures, and subdued economic growth prospects, activity in the national housing market continues to be supported by still favourable lending conditions – with competitive average concessions relative to prime, and rising mortgage approval rates enabling many South Africans to invest in their own home.

According to the latest statistics released by ooba, the national mortgage approval rate remained buoyant at 84.1% in September – the second consecutive month above 84% and a level last recorded in late-2021.

Buyers appear to be taking advantage of investment opportunities in the housing market facilitated by the still favourable lending conditions, with applications for investment or buy-to-let properties rebounding strongly in recent months, rising to 8.6% of total mortgage applications in September (see graph below), according to ooba.

Dr. Andrew Golding, chief executive of the Pam Golding Property group says: “These positive indicators reflect consumers’ sustained appetite for home ownership and investment in residential property, which is encouraging, particularly when seen against the backdrop of ongoing global and local economic challenges.

“Another trend which is contributing to steady activity in the residential property marketplace is the movement of people within South Africa – including ongoing semigration - which surged in Q3, with a record 14% of homeowners indicating that they were selling their homes in order to relocate within South Africa, according to FNB.

Meanwhile, the percentage of homeowners selling their homes in order to upgrade to a larger and/or more expensive home remained surprisingly high at 13% of all Q3 sales, given the current economic scenario of rising interest rates and subdued growth.”

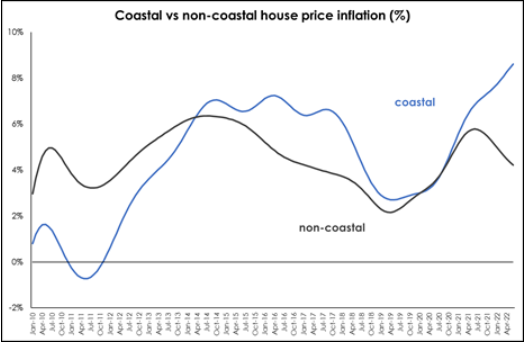

Coastal property price growth (within 5km of the coastline continues to accelerate, rising by +8.6% in June 2022 (latest available data), while non-coastal eased to +4.2%, causing the coastal price premium to widen to +4.4% which is the highest since mid-2005.

Dr. Golding says: “The growing coastal premium is underpinned in part by the semigration of homeowners from inland to coastal areas as well as the growing number of investors who may well favour coastal homes for the location of their investment properties.

“A shining light among the metros is Nelson Mandela Bay, which continues to register strengthening growth in prices, rising to an impressive 9.7% in June and averaging 9% during the first half of the year. This is more than double the pace of price growth in the two other coastal metro housing markets of Cape Town (4.0%) and Ethekwini (3.5%).

“Also of interest is that the Covid-induced boom in freehold price inflation continues to fade, with the gap between freehold and sectional title, which peaked at 4.0% in mid-2021, narrowing to just 1.5% in September 2022.” (Source: Lightstone)