The Real Estate industry could provide much-needed economic stimulus, with the impact of Covid-19 showing rising House Price inflation as SA heads for deep recession.

The property industry, with a R23,6bn per annum contribution to the economy has been hard hit by the slow unlocking of restrictions to deal with the Covid-19 pandemic.

The economic benefits of a moving property market are significant. An impact study done for REBOSA by Associate Professor François Viruly from the Urban Real Estate Research Unit of the University of Cape Town shows that it contributes 6% of GDP and estate agency commission alone is an estimated R9,3 billion and has a multiplier effect of 1.94, thus an economic impact of about R18 billion.

South Africa's real estate generates government revenue across the different tiers of up to R16bn (per the national budget for 2019/2020) plus additional revenue such as CGT, Deeds Office fees - not forgetting agents’ commission, attorneys’ fees, financial services, home improvements, removal companies and home inspections as part of the total value chain.

And while the deeds offices around the country have opened up after more than a week's delay due to Alert Level 4 risk requirements related to staff and hygiene - residential property operations will only be able to resume fully at Alert Level 2.

'Deep recession'

The country is headed for a deep recession this year, looking likely to be significantly more severe than the -1.5% GDP (Gross Domestic Product) contraction of 2009 (in what was called the Global Financial Crisis…or GFC for short). FNB forecasts a -4.5% GDP contraction, while certain other forecasters are more pessimistic.

It is evident that drastic measures are needed to encourage South Africans to invest in the economy and property market, says Samuel Seeff, chairman of the Seeff Property Group.

SEE: This is how much you will save on your bond after another 1% rate cut in less than a month

This is an unprecedented time and it calls for the Reserve Bank to step in with a bold rate cut of as much as up to two percent (200 basis points) as an immediate measure to stimulate demand in the economy, he says. The decision by the Reserve Bank to cut the repo rate by a further 100 basis points to 4.25% at the end of April, bringing the bond rate to 7.75%, is seen as absolutely necessary for the economy and property market - providing a significant 20% saving and boost for demand.

'Planned rate cuts will take too long'

While pleased with the one percent (100 basis points) cut to accommodate the lockdown period, Seeff says that it has now been extended with seemingly no end in sight. Reserve Bank Governor, Lesetja Kganyago’s mid-April statement that a further five cuts of 25 basis points between Q2 and Q1/2021 are planned, is simply not enough and will take too long.

As the Covid-19 Pandemic has unfolded, we have seen central banks globally respond with aggressive rate cuts and fiscal intervention. A meaningful cut that can reduce the prime interest rate to say around 5.75% and ideally below 5% before year end is needed to stimulate demand and activity across all sectors of the economy and property market in particular.

Seeff says further that the oil price has since plummeted and inflation, one of the biggest impacts on the interest rate, is contained with Stats SA announcing in late April that the CPI had dipped to 4,1% in March, down from the anticipated 4,6% (as at February). It is likely to come down further and could possibly dip below the 3% mark. The low fuel price is also likely to help contain inflation for some months to come.

READ: Modernising SA's cities | Rethinking public areas and the luxury of privacy, post Covid-19

While the Rand has expectedly declined due to the Moody’s and S&P downgrades and the Covid-19-induced economic outlook, a Bloomberg editorial of the 10th May makes the case for a rebound on the back of an emerging market recovery.

'70% lows of April worsen in May'

The SA economy has just about ground a halt.

"It was already in recession before going into lockdown and we have seen most sectors plummet in April with worse is to come for May. New car sales which is usually at around 40,000 per month, fell to just 500. Real estate volumes, which was already trading at about 30% below normal market conditions before lockdown, fell by at least 70% in April and will worsen in May," says Seeff further.

Seeff says that with the market in a battle to regain stability, a sharp cut in the repro rate will not only go a long way to stimulate a recovery, it will free up much-needed cash to push demand and upward growth for the economy.

There is a great deal of uncertainty in the market. Consumers and businesses are under enormous strain. A meaningful cut in the interest rate will alleviate the financial pressure on households and businesses and on the other hand, bring down borrowing costs to stimulate demand and economic activity.

"As the lockdown is eased, a drastic rate cut will be a lifeline for households and businesses. It will help keep more people in jobs, enable more SMME businesses to keep going and enable people to hold onto their homes and financed assets. More disposable income will stimulate retail and other sectors of the market including property," says Seeff.

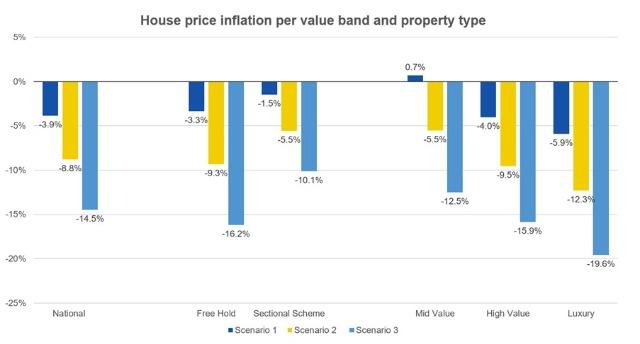

Three House Price Inflation scenarios that may play out during 2020

But as the stalled residential property market battles to gain stability, the added pressure imposed by the Covid-19 pandemic will see it bracing for severe inflationary impact, irrespective of sharp rate cuts.

Industry analysis by experts Lightstone put house price inflation at the end of 2019 at under 2%, with the last peak in 2014 at 6,35%. Before the Covid-19 crisis hit, 2020 national house price inflation was estimated to drop below the 0% barrier for the first time since the 2008 economic recession.

“With very little or no certainty on how this black swan event will ultimately play out, Lightstone decided to model three scenarios based on the GDP dropping between 3% to 10%,” says Analytics Director, Paul-Roux de Kock

For Scenario 1 or Generic Recession - House price inflation is forecasted based on the assumption that the GDP may decline by 3% with a subsequent deflationary effect on consumer price inflation. The reduction in CPI inflation leads to a further drop in interest rates making goods bought on credit more affordable.

“In this scenario, we expect house price inflation will end the year off at -3.9%.”

In Scenario 2, de Kock says, “A negative house price growth of 8,8% for Scenario 2 or Unchartered Territory sounds alarming, however when we look at the 2008 property crash, house price inflation dropped to as low as -5.4% during a time when economic growth only declined by 1.8%.”

This scenario assumes a drop in GDP of 6% without a noticeable reduction in CPI inflation, leaving limited moving room for further interest rate adjustments.

“In Scenario 3 we really stretched our forecast models – which was not built to perform under such extreme conditions - to its maximum. We assumed a negative GDP growth of 10% with an increased reliance on expensive imports due to the weaker currency ultimately driving CPI inflation up and forcing the Monetary Policy Committee to reverse the downward interest rate cycle.”

Under this scenario, Lightstone predicts that house price inflation could end the year off at -14.5% but warns that under such conditions “all bets are off” as the usual predictive interplay between GDP growth, CPI inflation, interest rates and house price inflation will start breaking down.

*Lightstone details these three scenarios as analytical predictions based on the potential outcome of the compounded effect of the lockdown restrictions on businesses and households. A more accurate forecast can only be made later in the year as the length and subsequent effects of the lockdown is better understood and reflected in home sales data.