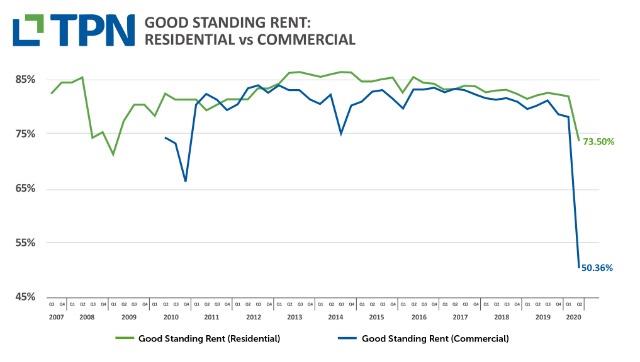

Financial pressure caused by the Covid-19 lockdown continues to impact the South African rental market, as the slow deterioration of tenants able to pay their rent on time hits a deep dive.

The steady deterioration of 5.43% over the last 6 years is hardly noticeable in comparison to the overnight drop to 50% in good standing in a single month between March and April, according to rental monitor data from TPN Credit Bureau.

READ | Western Cape remains the most expensive for renting in South Africa

READ: Evictions under Level 2 | Advice for tenants and landlords

And as the number of tenants in good standing plummets, landlords are unable to execute evictions.

"Residential eviction orders in Alert Level 3 where being granted with a 5 – 90 day stay on execution once Alert Level 3 ended. That means some landlords who obtained eviction orders in Alert Level 3 now have to wait till 17 November to execute. All the while tenants live rent free," says Dickens.

READ: SA rental market slump | 'Bond installment to average rental ratio widens to -26%'

The TPN Vacancy Survey for Q3 confirmed the distressed level of tenant demand, as vacancies have rocketed to 11.39%.

The picture gets even more murky as Dickens says market strength has plummeted to 41.3, "which indicates a market with reasonable a demand rating of 52.9 but an over supplied rating of 70.3, confirming there are less tenants in the market as landlords struggle to fill empty properties".

READ | Struggling with arrears? Here's how to manage your rentals to reduce debt