Inflation remained steady in the Eastern Cape, Gauteng, Limpopo and Mpumalanga; increased in the North West, Northern Cape and Western Cape; and decreased in the Free State and KwaZulu-Natal.

READ: SA's national house price inflation at 4.35% as entry-level outpaces luxury property market

Despite the recent acceleration in house price inflation in the Northern Cape – which has risen from a low of 3.35% in October 2020 to 8.83% in October 2021 – when comparing the average house price inflation rate for the 10 months of last year (latest available data from Lightstone), the Eastern Cape (with an average 7.04%) has outperformed the Northern Cape (6.21%).

Kimberley

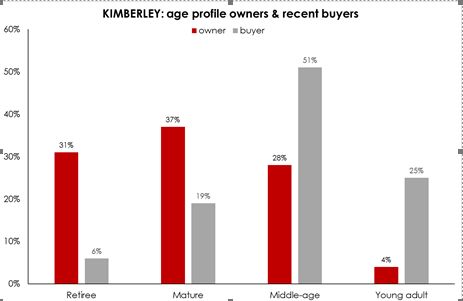

“Stable homeowners in Kimberley are predominantly ‘mature’ or ‘retirees’, while more than half of recent buyers were ‘middle-aged’ – with a further quarter ‘young adults’. This points to an influx of families and first-time buyers, says Sandra Gordon, Pam Golding Properties area principal.

Freehold homes account for approximately 95% of housing stock in Kimberley. Median prices of freehold homes have shown strong growth over the past decade – rising from R700 000 in 2012 to R1.395 million to date in 2022 - a near doubling of the median price of freehold homes over the past decade.

Activity has been elevated in recent years. Even if one were to exclude the 74 new affordable homes sold during the past 12 months, 2021 sales were still the second-highest recorded during the past decade - after 2019, notes Gordon.

Kimberly has currently 82* new property listings according to Property24 Trends Data, with the average asking price for the area being R1.6 million. The average sale price per erf for 2021 was about R1.2 million, while Section Scheme Units for the same period is about R819 000.

The latest residential listings on Property24 show that three-bedroom homes are most widely available, at an average list price of R1.54 million. Sellers in the area fall within the 50-64-years or older (31%), while 49% of buyers fall within36-49-years age group.

Click here to see all the latest trends data for Kimberly

Karoo

Relatively speaking, Wayne Rubidge, Pam Golding Properties area manager in the Karoo, says "rural Northern Cape Karoo properties have come off a low base. The return on investment in many of the towns we service is substantial - anything from 10-20% per annum growth and even more in a few of the towns that are established investment destinations".

VanderKloof, the resort town on the Orange River or the banks of the Vanderkloof town is one such town. What is driving these prices is the post-Covid consideration of the virtues of owning a property in the Karoo - where security and a healthy environment are the main attractions, says Rubidge.

SEE: 5 spectacular Karoo lifestyle farms priced from R345k

"Larger regional towns like De Aar, Prieska and others see continual growth due to the expansion of the government investment into these regional/district towns for improved anticipated service delivery.

Before investing in a town investors must consider the short to medium-term future growth potential of the town which is often related to service delivery. Some towns may take a while to see growth while others are attracting new homeowners as properties become available, he advises.

“Supply is often a constraint. Take Richmond as an example. The Pam Golding Properties agent there sells everything saleable almost immediately as it comes onto the market. We urge buyers in a town like this to talk to a reputable and experienced agent to be in a position to act quickly when a suitable property comes on the market.”

Karoo has currently 74* new property listings according to Property24 Trends Data, with the average asking price for the area being R1 202 500. The average sale price per erf for 2021 was about R469 000, while Section Scheme Units for the same period is about R4 182 330.

The latest residential listings on Property24 show that three-bedroom homes are most widely available, at an average list price of R1.05 million. Sellers in the area fall within the 50-64-years or older (26%), while 49% of buyers fall within the same age group.

Click here to see all the latest trends data for Karoo

Rural North Cape

According to Charles Rubidge, area principal in Rural North Cape, two main economic activities are driving the positive economic outlook in the Northern Cape, namely agriculture and mining. The areas affected by the mining growth are in particular : Kathu, Kuruman and Postmasburg.

“There has been a steady increase in the increase of iron ore and manganese ore which are currently trading at a high on the world market. Numerous new mining licences have been issued for exploration in the areas and older mines are being reopened,” says Rubidge.

“Due to this increased activity, there is pressure on the residential market in these areas, both for rental and sales. There are very few new housing developments as investors and developers are hesitant because the commodity prices are fickle and could drop fast to levels seen in 2015 to 2017. During this period the house prices dropped dramatically, and the rental market was in complete over-supply.”

“It is estimated that the manganese and ore price will remain constant for the next few years and due to the possible slide of the Rand against the US dollar.

“We believe that developers will begin to enter the market in the next 18 months. However, currently, the housing shortage will remain and place pressure on prices.

“Agriculture remains buoyant along the Vaal river and Orange river irrigation regions – particularly with the increase in peacan nut production and the opening of the Middle Eastern markets for lucerne.

However, Rebidge says this does not place as much pressure on the housing market in the areas, Douglas, Hopetown, Upington through to Kakamas. These areas and particularly the lower Orange River area have seen a large expansion in the export markets for grapes and wine – the investment is positive – and in these areas, there is a housing shortage in the lower end of the market. In the Vaal Harts, region prices have remained constant, with the higher-end properties in short supply.

Want all the latest property news and curated hot property listings sent directly to your inbox? Register for Property24’s Hot Properties, Lifestyle and Weekly Property Trends newsletters or follow us on Twitter, Instagram or Facebook.

*Property24 Listings Data Disclaimer: The trends detailed in this article are based on Property24 listings, current at the time of publishing, and property transfer data supplied by Deeds offices, which typically take 3-4 months to reflect. Suburbs are listed according to Property24's geographical database. In some areas this will include both commercial and residential properties. The age demographic data of buyers, sellers and stable owners is determined over a six-month period. These Property Values should not be used as a substitute for independent professional advice and is subject to Property24.com Terms and Conditions