The current resurgence in residential and commercial market activity in Midrand has highlighted the area’s desirability as the place to live, invest and work, with agents reporting a notable spike in first-time buyers and investors.

This is according to Grahame Diedericks, Manager Principal for Lew Geffen Sotheby’s International Realty in the area.

“Although activity was somewhat subdued by the impact of the pandemic, it fared considerably better than many other areas in Gauteng with ongoing development and steady sales during the past year as well as an increase in median prices across the board.

“Lightstone data reveals that median selling prices rose significantly this year with sectional title prices increasing from R740 000 to R899 000 and freehold prices from R826 000 to R1.2 million.

'Jump in median value of vacant land'

“However, the most telling indicator has been a jump in the median value of vacant land, which has increased steadily from R361 000 in 2017 to R2 million by July 2021.”

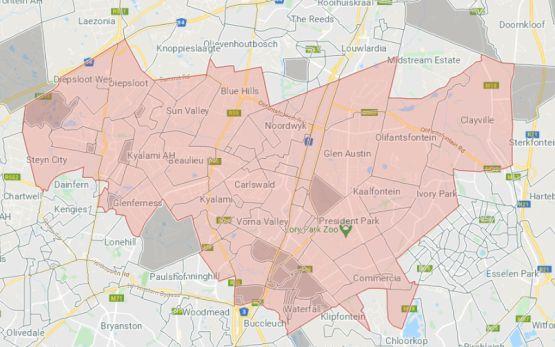

Diedericks attributes the market’s stability during challenging times to a number of key factors, including the diversity of property on offer, its central location equidistant to Pretoria and Johannesburg and ongoing commercial development.

“Buyers have a very wide choice of residential property, from very accessibly priced apartments and modern sectional title developments to upmarket gated communities and luxurious, state-of-the-art homes in secure gated communities like Stein City Parkland Residence and Waterfall.

“Extensive commercial development in the area has also attracted many new residents who not only want to live near work but are also drawn by the fact that they can get more bang for their buck than in Johannesburg’s more established northern suburbs.”

The latest residential listings on Property24 show that two-plus bedroom homes are most widely available, at an average list price of R850 000. Sellers in the area fall within the 36-49 years (44%), while 43% of buyers within 18-35 years - followed by 40% within 36-49 year age group.

Diedericks adds that the area’s central location has also spurred a growing number of businesses, including corporate headquarters, to move into Midrand’s commercial node from both Sandton and Pretoria and it’s also home to large-scale industries such as textiles and motor vehicles.

“In addition to the accessibility for employees from Johannesburg and Pretoria, Midrand also offers a wide range of commercial property options, especially for companies which are downsizing at the moment, whether it be for financial reasons or because of increased remote working.

“And, with the upgrade of convenience centres such as Kyalami on Main and Crowthorne Shopping Centre, the development of Kyalami Corner and the ever-expanding Mall of Africa and surrounding Waterfall Centres have, Midrand has become one of Johannesburg’s shopping and lifestyle hotspots.”

Diedericks says that with all the world-class amenities now in Midrand as well as a burgeoning commercial sector, it’s no surprise that, according to Lightstone’s buyer demographic, 91% of all recent buyers are aged 49 or younger.

“And, the fact that there were 637 repeat sales during the last three months alone highlights the fact that Midrand, in general, is great value for money as well as a solid investment, but the old adage ‘location, location, location’ still applies.

“Do a little homework and get to know the different areas with regards to convenience, amenities, schools, surrounding developments, both current and future and also find out what the market in your wants if you are looking at investment properties, both residential and commercial.”

In recent years, Midrand has become a key growth point in Gauteng, largely driven by the rampant commercial and residential development, affordable quality homes across all sectors and its central location with the Gautrain offering easy access to Johannesburg and Pretoria, says Diedericks.

Want all the latest property news and curated hot property listings sent directly to your inbox? Register for Property24’s Hot Properties, Lifestyle and Weekly Property Trends newsletters or follow us on Twitter, Instagram or Facebook.

*Property24 Listings Data Disclaimer: The trends detailed in this article are based on Property24 listings, current at the time of publishing, and property transfer data supplied by Deeds offices, which typically take 3-4 months to reflect. Suburbs are listed according to Property24's geographical database. In some areas this will include both commercial and residential properties. The age demographic data of buyers, sellers and stable owners is determined over a six-month period. These Property Values should not be used as a substitute for independent professional advice and is subject to Property24.com Terms and Conditions.