Prices for high-end homes in the Silver Lakes Golf Estate to the east of Pretoria have climbed steeply in recent months in response to a growing shortage of stock.

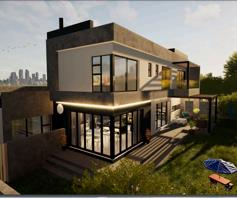

This five bedroom, four bathroom home for sale in Silver Lakes Golf Estate in Pretoria has four living areas, a study, kitchen with scullery and pantry, staff accommodation, three garages and a pool. It is on the market for R7.5 million - click here to view.

This five bedroom, four bathroom home for sale in Silver Lakes Golf Estate in Pretoria has four living areas, a study, kitchen with scullery and pantry, staff accommodation, three garages and a pool. It is on the market for R7.5 million - click here to view.This is according to Anne-Marie Scholtz, owner of RealNet Elegance, who says the average price of recent sales in Silver Lakes has been around R4 million.

“And although it is definitely the premier estate in the area, we are now experiencing more robust sales in the surrounding estates like The Meadows and Six Fountains, where buyers currently have a greater choice of homes for sale and the average price is only around R2.7 million,” she says.

“Developers are also active in the area again, offering new projects such as Newmark Estate where four bedroom homes with three bathrooms, two lounges and staff accommodation are available for R2.85 million, all costs included.”

Scholtz says the Willow Acres and Six Fountains estates are also popular choices because they offer easy access to the N4 freeway, Lynnwood Road and excellent shopping facilities

This three bedroom, two bathroom home selling in The Meadows @ Hazeldean in Pretoria has a study and two garages. It is on sale for R2.65 million - click here to view.

This three bedroom, two bathroom home selling in The Meadows @ Hazeldean in Pretoria has a study and two garages. It is on sale for R2.65 million - click here to view.“In Hazeldean, we are seeing strong demand from executives and professionals with school-going children in The Meadows, which offers homes in the popular R2 million to R3 million category and proximity to the Curro Hazeldean independent schools,” she says.

“In fact, these schools, as well as other private institutions like Tyger Valley College and Abbotts College, are major drawcards to this whole area.”

There is also a popular retirement development in Hazeldean called The Retreat, which has a privately-owned frailcare facility, and another upmarket estate named The Ridge, which is a low-density development offering vacant land as well as completed homes.

This four bedroom, three bathroom home for sale in Newmark Estate in Pretoria East has a kitchen with gas stove and scullery, a bar, study and garden with separate boma area. It is selling for R3.45 million - click here to view.

This four bedroom, three bathroom home for sale in Newmark Estate in Pretoria East has a kitchen with gas stove and scullery, a bar, study and garden with separate boma area. It is selling for R3.45 million - click here to view.She says Silver Lakes and the surrounding estates also attract many buy-to-let investors, who mostly let to corporates seeking to accommodate foreign executives working in South Africa on three- to five-year contracts.

The demand among such buyers is generally for homes priced at under R3.5 million, and the gross return they can expect is around 8%.

“After levies and rates, this translates into a return of 6% on the investment, which is very good, considering the price of the property,” says Scholtz.

“And our investors are primarily cash buyers or people with excellent credit records, which means we hardly ever lose such sales due to bonds not being approved.”