First-time buyers account for more than 50% of those looking to purchase a home under the current low 7% interest rate - but many who qualify for a FLISP saving are not aware of it.

Ooba data shows first-time buyers have boosted sales, representing 54.5% of bond originator's home loans in July, while the trailing effective bond approval rate rebounded to 82.2% in July and is rapidly approaching levels seen in the months before lockdown.

ooba’s approval rate for pre-qualified buyers of 91% and 79% for non-qualified buyers continued to recover in July, with the pre-qualified rate now back to pre-lockdown levels.

'100% bond applications approval rates increase'

Positively for home buyers, the average deposit as a percentage of purchase price remained relatively low at 8.2% in July, still close to May’s record low of 6.7% (ooba’s series started in mid-2007), while 100% bond applications stood at 63.2% in July, with an approval rate of 81.7% in the same month.”

READ | SARB keeps repo-rate unchanged. Has the rate cuts spree come to an end?

The average bond amount has increased from R1 million to R1.2 million, says Carl Coetzee, CEO for BetterBond and almost 60% of all applications approved in August were for bonds of 100% and higher of the purchase price. Furthermore, the average amount of the deposit required for a bond has also dropped across all price segments, says Coetzee, “as banks show their willingness to grant larger bonds”.

The secret to saving thousands of rand when you buy

But there's a property secret all first-time buyers need to know: 'How to make money when you buy your property.'

Thousands of first-time home owners are not aware of this unique opportunity - Finance Linked Individual Subsidy Programme, in short FLISP. A recent survey conducted for a company who provided financing of R1 billion to their employees to purchase their own properties was conducted.

"Out of 45 applicants who are first time buyers and whose home loans were approved, only four of these potential home owners knew about available FLISP subsidies,” says Meyer de Waal, the founder of My Bond Fitness and a director of MDW INC Attorneys.

The concept of FLISP, is no longer a secret, but as so few home buyers are aware of it, it appears still to be an industry secret.

Buyers who qualify for such subsidies can save thousands of Rands on the purchase price of their dream home, or reduce their home loan and save thousands during the usual 20- or 30-year home loan repayment period.

A first-time buyer may ask – “How do I find properties before the seasoned property buyers get their hands on them, that are selling for less than market price? The answer is simple – This unique opportunity to pay up to R 123 000 less for a property is available for all first-time home buyers.

READ: 6 Reasons why a deposit is important when buying property

The Savings

De Waal did a few calculations on how a FLISP subsidy can reduce the purchase price for a first-time buyer. He says a buyer can thus end up paying less for his property. The subsidy can be used as a deposit to reduce the actual purchase price the buyer will pay. This subsidy can also be added to an approved home loan to enable the buyer to buy a more expensive property.

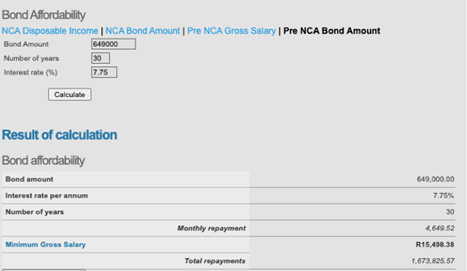

Pay R59 000 less for your property

We used an income of a buyer who earns R 15 500.00 per month and calculated a home loan repayment over a 30-year period of time at an interest rate of 7.75 % [considering the prime lending rate is 7% at the moment.

Based on such information, the buyer may qualify for a property purchase price of R649 000.

A FLISP subsidy of R59 000 will be available.

The result is that the buyer pays R590 000 for a R649 000 property – which means R59 000 less for the property.

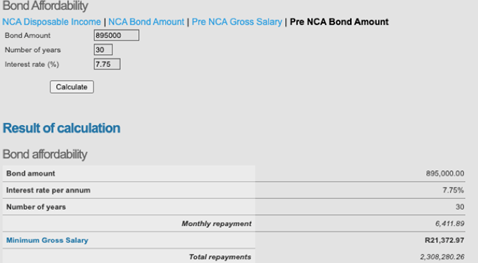

Pay R 31 000 less for your property

We used an income of a buyer who earns R21 400 per month and calculated a home loan repayment over a 30-year period of time at an interest rate of 7.75 %, considering the prime lending rate is 7% at the moment.

Based on such information, the buyer may qualify for a property purchase price of R895 000.

A FLISP subsidy of R31 000 will be available.

The result is that the buyer pays R864 000 for a R895 000 property – which means R31 000 less for the property.

How do you qualify for a FLISP subsidy?

There are a few requirements to qualify for this subsidy, says Anele Matakane of My Bond Fitness, a company that assist home buyers with their FLISP subsidy and home loan applications.

These requirements are:

- An approved home loan application;

- at this stage only home loans by the four “big” banks are recognized for a FLISP subsidy, such being ABSA, FNB, Standard Bank and Nedbank;

- You must earn between R3 501 – R22 000;

- based on the combined household income of the applicant/s;

- You must have a financial dependent;

- such as a spouse or a child;

- You must not have owned a property prior to the subsidy application;

- The buyer must be a South African Citizen.

The subsidies are available on a sliding scale, which means that a person who earns R3 501 per month can qualify for a subsidy of R121 626.

A person who earns R15 000 can qualify for a subsidy of R63 000, and a person who earns R22 000 can qualify for R 27 960.

To calculate a FLISP subsidy, use the handy FLISP Subsidy calculator.

Buyers can also establish if they can qualify for a subsidy and complete an online survey.

For more information, go to the FLISP website.