In 2017 and 2018, the Garden Route was devastated by fires which destroyed over 1 000 homes and ravaged huge tracts of land and infrastructure. However, not only has much of the damaged property on this scenic coastal stretch already been rebuilt, the market is now one of the most buoyant in the country.

While fire scarred the coastline from Mossel Bay to St Francis Bay, the quaint seaside town of Knysna and its outlying areas bore the brunt of the 2017 fires. It caused some R3 billion in damages, including over 900 houses that were destroyed or rendered uninhabitable.

But the area has rebounded remarkably well considering the adverse prevailing circumstances, says Peter Maré, Co-Principal in Knysna and Sedgefield for Lew Geffen Sotheby’s International Realty, with around 70% of the damaged properties already rebuilt or in the process of being repaired or rebuilt.

“Most of the restored homes have been rebuilt by the owners, but some of the damaged properties, especially those that were under-insured, have been sold ‘as is’ to new owners, most of whom plan to demolish the existing structures and build brand new homes.”

Maré says much of the town’s recovery can be attributed to an encouragingly resilient market, which has been underpinned by ongoing semigration.

“Despite the subdued economy and the disruption of the pandemic, the property market has remained fairly strong and we are fielding enquiries from a growing number of families looking to relocate from the bigger cities in search of a different lifestyle that will afford them a better quality of life,” he says.

“And, interestingly, we are currently also seeing considerable interest from German buyers, which is largely due to increasing concern in Europe about the viability of the European Union and the financial burden that will be placed on productive countries within the EU.”

Steve Neufeld, Manager Principal for the group in Plettenberg Bay, reports a similar scenario in this Garden Route hotspot. He says not only have the vast majority of the damaged properties already been repaired or rebuilt, 2020 also turned out to be a bumper year for the real estate market.

“In 2019 we experienced a slight market slump due to the economic downturn and, as anticipated, 2020 got off to a slow start. However, despite all expectations to the contrary, once the hard lockdown period ended, the market rebounded with unexpected speed and strength,” reports Neufeld.

“In fact, 2020 ended up being one of the best years we’ve ever had in terms of sales value for our office and we also negotiated the group’s second-highest sale price achieved for the year with the sale of a stunning oceanfront home at Beachy Head.”

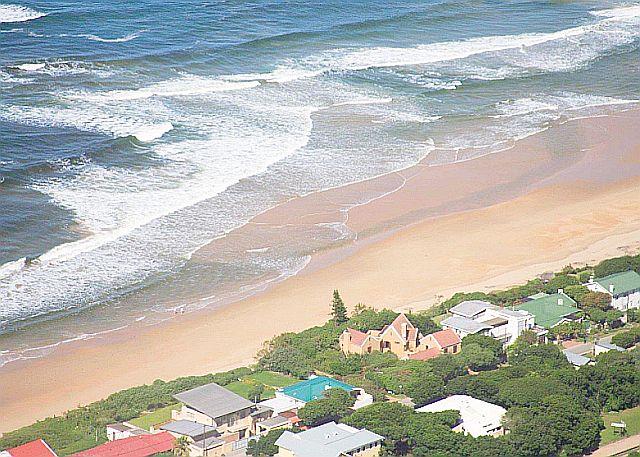

The rebuild that best showcases investor confidence in Plettenberg Bay is a unique 2 000sqm clifftop property, which is set in a 48ha private nature reserve with panoramic views of the rugged and majestic Indian Ocean coastline.

Badly damaged, considerable investment and commitment was required to restore this expansive 10-bedroom establishment with an array of high-end amenities which was on the market at the time of the fire. A rare investment opportunity for a discerning buyer, it’s now back on the market for R75 million.

Further down the coast, the town of George and its immediate residential suburbs were relatively unaffected by the fires, but the adjacent wooded areas weren’t spared and districts like Wilderness, Outeniqua and the Lakes were devastated.

However, according to George and Wilderness Principal for the group, Tim Kirby, most of the affected areas are back to normal, especially Wilderness where all of the damaged properties have been rebuilt and there is little remaining evidence of the fire’s destruction.

Kirby adds that the market has also been extremely buoyant with a notable shift in the buyer demographic. “Only a small percentage of our recent and current buyers are local; the majority hail from Gauteng, the Free State and Cape Town and, although we are still receiving enquiries from retirees, most are now young professional families in the 35 to 45-year age group.”

The pandemic has shown professionals like architects, chartered accountants and attorneys that they are able to work remotely and can therefore live wherever they choose to - and George meets all of their needs.

The airport allows them to easily commute to major centres when necessary and they also have access to top schooling and medical facilities as well as a comprehensive variety of retail options and myriad outdoor activities, including hiking, cycling and close proximity to beautiful beaches.

As one would expect, the number of freehold and sectional title registrations in George dropped in 2020, the median price in both sectors increased with the median apartments price growing from R772 000 to R900 000 and houses from R1.5 million to R1.569 million, according to Lew Geffen Sotheby’s International Realty data.

Kirby says the most popular selling price band at the moment is between R2 million and R3 million but there is very little stock available.

And although Mossel Bay mercifully escaped largely unscathed with only a couple of properties lost in outlying Hartenbos Heuwels and Heiderand, this often-overlooked Garden Route town has come into its own with a notable uptick in enquiries from upcountry buyers looking to relocate.

Area Specialist, Anette van den Berg, says: There has been a notable increase in market activity in recent months with most of the buyers being from Gauteng. The two most common reasons given for moving to the area are for a more tranquil, better quality of life and for improved municipal management and services.

“The majority of our sellers are empty nesters and retirees who are scaling down or moving to the retirement village,” states Van den Berg.

She adds that there has also been an uptick in development with developers currently building secure complexes on adjacent farmland that has been rezoned from agricultural to residential.

“Although the region is well on its way to a full recovery and we are enjoying better than anticipated market activity, the remaining scattering of burned out shells serve as a harsh remembrance of the devastation wreaked and the hard lesson learnt by many about the folly of inadequate insurance,” says Maré.

Want all the latest property news and curated hot property listings sent directly to your inbox? Register for Property24’s Hot Properties, Lifestyle and Weekly Property Trends newsletters or follow us on Twitter, Instagram or Facebook.