Residents of Diepsloot, north of Johannesburg in Gauteng can look forward to a new regional shopping centre set to open in September 2013.

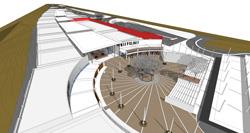

Investec Property will develop the 25 000 square metre new regional shopping centre to be known as Endaweni in Diepsloot Extension 10 at a cost of approximately R275 million.

Investec Property will develop the 25 000 square metre new regional shopping centre to be known as Endaweni in Diepsloot Extension 10 at a cost of approximately R275 million.

Construction of the centre will commence soon, says Ronnie Sevitz of Investec Property

He says national tenants already committed to the centre include Checkers, the Edcon Group, Foschini Group, Mr Price Group, Pepkor Group and a number of furniture stores.

Sevitz explains that the Endaweni Shopping Centre will be one of two centres, which will serve Diepsloot and its surrounding communities.

Located on the edge of the Diepsloot community and bordering onto the N14, it is easily accessible from the R114 and R511, both of which connect the centre to the Fourways and surrounding communities.

With its close proximity to local schools, the development team is exploring a number of initiatives involving the schools in the area, he says.

“Investec Property looks to develop new centres where strong demand exists from both retailers and large communities,” he says.

The Diepsloot community is large as are the surrounding areas that can benefit from a development in the area.

“Endaweni will link retailers directly to a community of about 150 000 people where nothing like it has existed before.”

He points out that this is not the first development for Investec Property in the community areas such as Diepsloot.

The design of the centre is unique in that it not only accommodates a range of national tenants but also houses a large complement of restaurants, which are expected to be a major attraction for local communities, drawing people to the development and the centre.

Ample provision is being made in the design to accommodate special parking for taxis as well as additional motor vehicles, he adds.

Meanwhile, Lephalale Mall in Limpopo will open its first phase of retail measuring 14 800 square metres on 22 November 2012.

Lephalale Mall in Limpopo will open its first phase of retail measuring 14 800 square metres on 22 November 2012. Anchor tenants include Game occupying 4 200 square metre store and Checkers which will take up 4 100 square metre store.

Anchor tenants include Game occupying a 4 200 square metre store and Checkers which will take up a 4 100 square metre store.

Other retailers include Jet, Edgars Active, Mr Price Home, Mr Price Sport, Spitz, Studio 88, Rage Shoes, King Pie, MTN, Torga Optical and many more.

Lephalale Mall is located at the corners of main arterial Nelson Mandela Road, Apiesdoorn Avenue and Onverwacht Road, on the western edge of the Onverwacht new CBD in a major residential growth node.

It will serve residents of the established Ellisras town, Maropong and the surrounding areas.

Lephalale Mall is on the corners of main arterial Nelson Mandela Road, Apiesdoorn Avenue and Onverwacht Road, on the western edge of the Onverwacht new CBD in a major residential growth node.

The mall development is a joint venture between Moolman Group and Uniqon (Pty) Ltd and construction of the mall began in January 2012.

Steph Beyers, development director of Moolman Group, reports that Lephalale Mall has the potential to grow to a regional mall of 42 000 square metres.

The mall and surrounding node will ultimately consist of 70 000 square metres of retail and other commercial space once fully developed, says Beyers.

Lephalale Mall will be a dominant retail shopping centre serving the needs of this fast expanding town.

Local residents will enjoy a new shopping experience with all the shops and products they want at a single modern location, he says.

Beyers points out that growing coal mining and power generating activities are the driving forces behind Lephalale’s growing economy.

The Waterberg Coal Field in Lephalale is one of the largest coal fields in South Africa.

It is little wonder then that Lephalale’s growth is driven by mining expansion. Exxaro Grootegeluk Mine - already the biggest of its kind in the world - is now increasing in size, he says.

Power generation is also fuelling the local economy with the construction of the new Medupi Power Station well on the way.

It joins Matimba Power Station, the largest direct dry-cooled power station in the world.

Further, widespread agriculture, game farming and tourism are elevating Lephalale’s status on South Africa’s economic map.

Lephalale Mall itself will play a significant part in the area’s economic development, as it grows with its market, creates opportunities, jobs, and attracts local spending.

Henry Bendeman of Uniqon says retail is important in any community and Lephalale Mall will serve local shopping needs in a quality, modern setting which is central for the town and its neighbours.

Founded in Polokwane, Moolman Group has operated in the property industry for more than four decades.

Its core business is the development and acquisition of property investment and they co-developed the Mall of the North and Makro in Polokwane, among other projects in the province.

Uniqon has a successful track record of almost 30 years specialising in property investment, development and management across retail, commercial and residential property. – Denise Mhlanga