The Pam Golding Residential Property Index highlights some ongoing shifts in the national housing market. These include the fact that the Covid-induced boom in freehold residential property price inflation continues to fade when compared with sectional title, with the gap narrowing to a revised 2.4% in April 2022, having peaked at 3.9% in March 2021.

Dr Andrew Golding, chief executive of the Pam Golding Property group says this would indicate that the convenience factor and appeal of lock-up-and-go sectional title properties in prime locations and hubs around the country, including those in vibrant mixed-use developments and lifestyle estates, has re-emerged as everyday life more or less returns to normality. This has offset, to some degree, the increased demand seen during the early waves of Covid for properties with more living and open space.

The Index also reveals that while non-coastal residential property price growth has slowed sharply to 4.8% in January 2022 (latest data), price growth of coastal homes (located within 5km of the coastline) remained steady at a robust 6.8% that month, revealing that the coastal price premium widened to over 2% for the first time since early-2018.

Dr Golding points out that this would indicate an increased demand for homes along South Africa’s extensive, scenic coastline, which offers a wide variety of highly appealing locations from metros to tranquil hamlets, as well as an ongoing trend towards semigration for a host of reasons.

SEE: These countryside towns are luring home buyers away from the city

“Apart from those seeking immediate or future retirement, a leisure property, or a more balanced lifestyle – including those with young families, due to its very nature, the coastal property has and always will enjoy a strong demand, particularly as many continue to be able to work from home in a preferred location.”

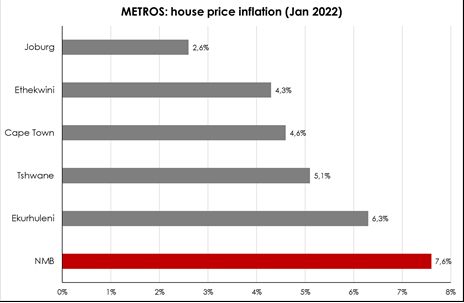

While house price growth in all major metro housing markets is now slowing, Nelson Mandela Bay (a smaller metro housing market) remains the top-performing market with a recent data revision by Lightstone showing a renewed acceleration in house price inflation of 7.6% in January 2022 (latest data).

Among the major metro housing markets, Ekurhuleni continues to outperform with a growth of 6.3% in January 2022, while Tshwane is also showing resilience with a house price growth of 5.1%. These two Gauteng metro housing markets are followed by Cape Town at 4.6%, eThekwini at 4.3% and Johannesburg at just 2.6%.

Dip in Average House Prices

According to Lightstone, year-to-date, the Average Price Changes per annum for sectional titles is down by 2% and 3% down for freehold properties. The Average Active RE/MAX Listing Price for the fourth quarter amounted to R3 291 021.53. This is a 6% increase QoQ and a 1% decrease YoY.

“The property market works in cycles, which is why real estate is designed to be a long-term investment so that the highs will balance out the lows. Real estate remains such a high-yielding investment strategy when approached in this way,” says Goslett.

Lightstone Property data also reveals that the average bond amount granted during this period amounted to R1 315 000. The RE/MAX National Housing Reports reflect that this is an increase of 7% YoY. “With the average bond amount climbing, my only caution is that buyers leave room in their budget to make allowances for the coming interest rate hikes,” says Goslett.

Interestingly, house prices in the Northern Cape continue to soar, reaching 9.2% in January 2022 (latest data), while growth in house prices in the Eastern Cape inched higher, rising by 6.45% in the same month.

From a national perspective, where data is available to April 2022, the slowdown in house price inflation continues, easing from a mid-2021 peak of 5.9% to 4.8% in April 2022. After averaging 5.7% last year, house price inflation has averaged 4.95% in the year to date. The Western Cape recorded the strongest growth rate of 6.3% in April 2022, followed by KwaZulu-Natal at 5.2% and Gauteng 4.2%.

Want all the latest property news and curated hot property listings sent directly to your inbox? Register for Property24’s Hot Properties, Lifestyle and Weekly Property Trends newsletters or follow us on Twitter, Instagram or Facebook.