House prices in major municipalities have increased, according to the latest Lightstone Data. The City of Johannesburg specifically increased by 3.6% in February this year, compared with a price growth of just 2% in 2017. The City of Tshwane has enjoyed a house price growth of 4.3%, compared with the 2.5% it was five years ago, Ekurhuleni has shown the biggest surge with inflation of 5.9% in February.

SEE: Want to find out what homes actually sold for?

The property market overall is being spurred by the positive impact of lower interest rates, still being felt around the country, as house price growth continues to accelerate in all provinces. Mpumalanga, North West and the Eastern Cape standing out as the top performers.

READ: The average purchase price South Africans are paying for a home

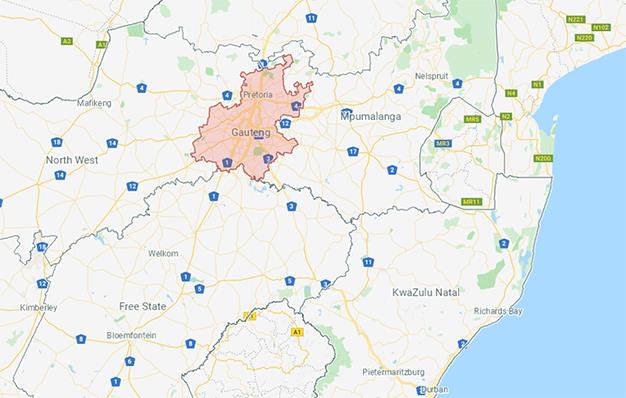

But what can you expect to pay in the province of Gauteng? Property24 Trends data shows that the average asking price in the Gauteng is currently in the region of R1.295 million. This is slightly higher than the average asking price during the height of the pandemic in 2020 - about R1.270 million. It is also an estimated 4% above the pre-pandemic year of 2019's asking price R1.240 million.

South Africa's average purchase price has seen double-digit growth of 16.3% year-on-year for the second quarter of 2021 (Q2 21) compared to Q2 20. The Average Purchase Price is at a high of R1,407,071, according to Ooba Barometer data.

The Average Purchase Price of First-time Buyers showed a 10.9% increase for the same period reaching an average price of R1,104,351.

'Competitive lending environment'

Of the home loan applications submitted to ooba in the last quarter, it is evident that 100% bonds are very sought after amongst first-time homebuyers.

"In the current highly competitive home loan landscape, lending and pricing decisions can differ vastly from bank to bank," says Rhys Dyer, CEO of ooba.

"Currently, 60% of first-time homebuyers acquire property without access to a deposit. Bank approval rates on 100% bonds for first-time homebuyers remain strong. Just over 80% of ooba’s first-time buyers seeking a zero-deposit home loan successfully secured bank approval in Q2 21."

Want all the latest property news and curated hot property listings sent directly to your inbox? Register for Property24’s Hot Properties, Lifestyle and Weekly Property Trends newsletters or follow us on Twitter, Instagram or Facebook.

*Property24 Listings Data Disclaimer: The trends detailed in this article are based on Property24 listings, current at the time of publishing, and property transfer data supplied by Deeds offices, which typically take 3-4 months to reflect. Suburbs are listed according to Property24's geographical database. In some areas this will include both commercial and residential properties. The age demographic data of buyers, sellers and stable owners is determined over a six-month period. These Property Values should not be used as a substitute for independent professional advice and is subject to Property24.com Terms and Conditions.